4 Charts to Easily Study for Add-ons and Continuations

PLUS, 10 sells this week with a SPY breakout!

Truncated email? You can click on "View entire message" and be able to view the entire post in your email app.

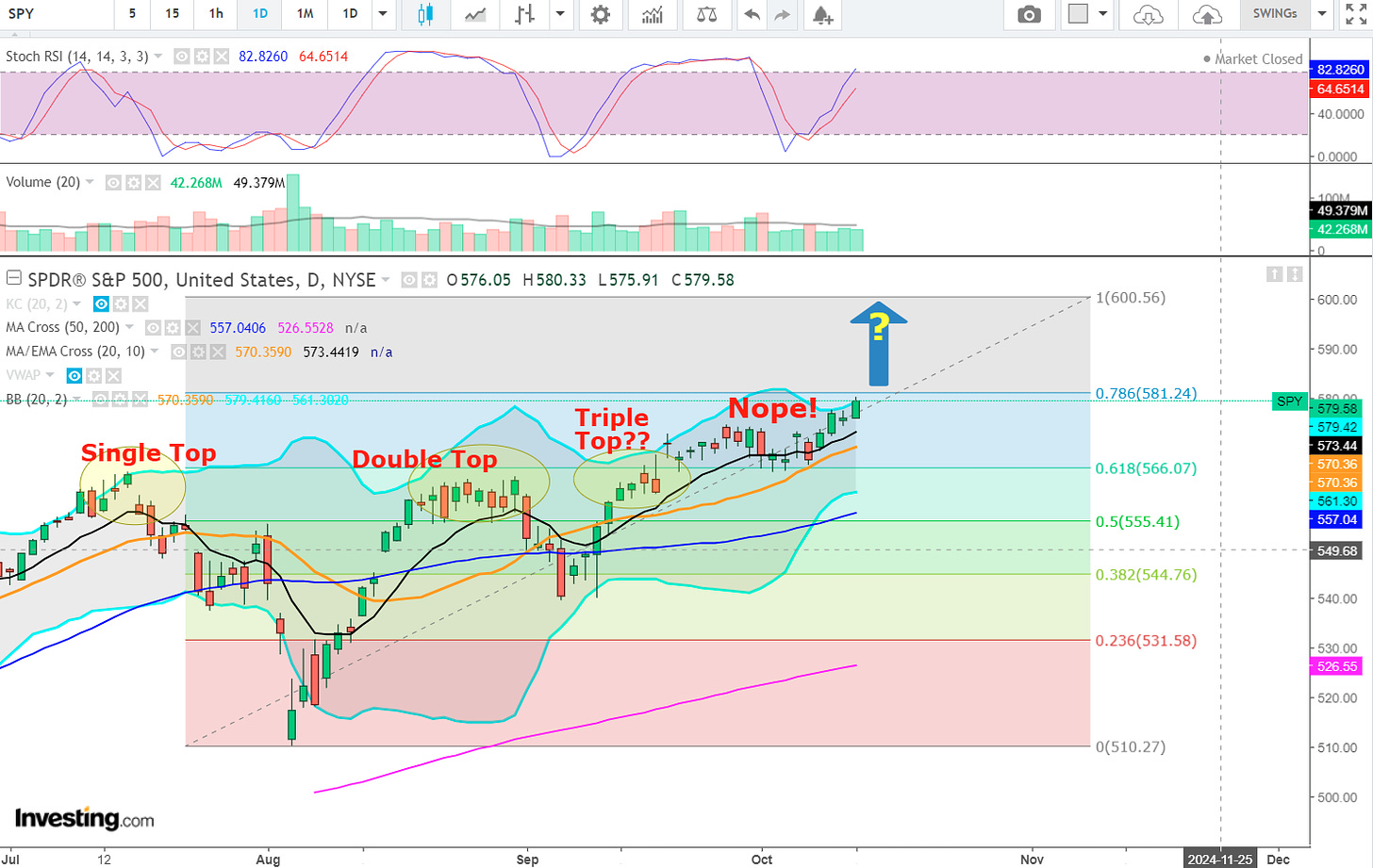

The SPY finally broke out of its slump this week. Our buys and sells were drying up until Friday when 5 of the 10 sells occurred. Wednesday had zero buys and Thursday had zero sells. Such is the sport of trading.

Here’s hoping the SPY continues this run and pulls the rest of our positions up with it.

A lot of meat in today’s chart studies as I have 3 that are somewhat interconnected in the ways you can justify enters (bids) and exits (asks). I’ll try to be brief, but that’s hardly my forte.

All 3 selections are on today’s Daily Bid List for Monday, 13oct2024. [Yes, my Canadian friends who are celebrating Thanksgiving with a Monday holiday, the US markets will be open. Happy Thanksgiving!]

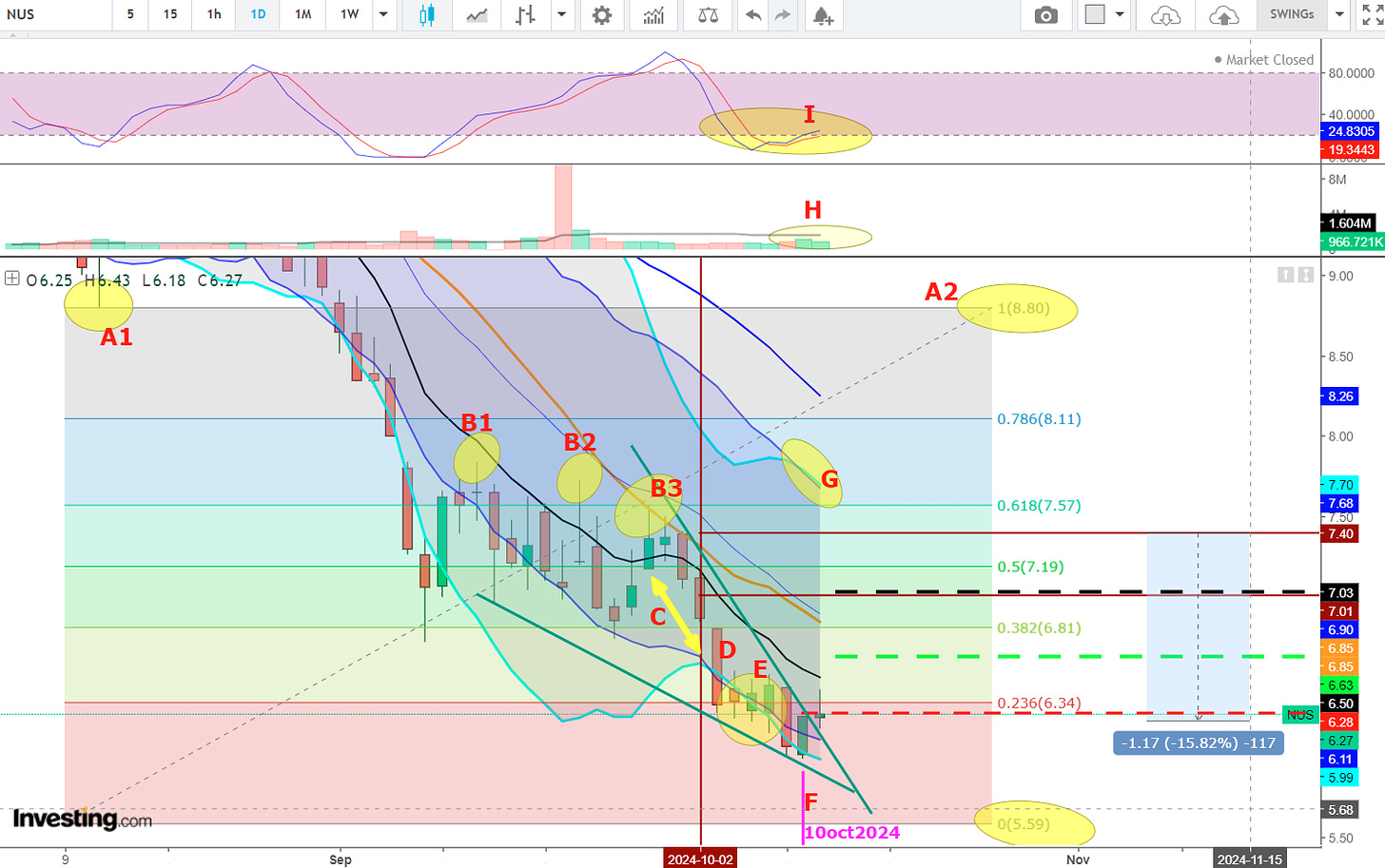

Let’s start with the NUS daily chart, a position originally bought 02oct2024. This play is a little riskier as we’re really moving AGAINST THE TREND. However, it’s showing several signs of a reversal in this area.

A1, A2 – In the longer term, this may be a target price and, I’m guessing, that will occur only after the 50 sma (simple moving average – dark blue line) hits the Fibonacci Tool’s 61.8% level which is currently $7.57. This will change over time as we determine a bottom and adjust for the price action that follows.

B1, B2, B3 – Usually we would look for 3 tops in a straight, angled line to help make a timing decision on the entry. We don’t have that here, but wait till Point F. The 3 B’s are highlighted as a fight between the bulls (buyers) and the bears (sellers). I feel all 3 points were trying to settle on the true upper resistance and finally agreed on B3. Why is B3 the Fib 61.8%? Well, it’s because…

C, D - … B3 is the final high pivot before the downside break out by candle D.

E – A few things are happening with these candles. We see a 4 day pause in meaningful volatility around the Fib 23.6% level before the next move down. This pause actually re-triggers the Keltner Channel to move back between the Bollinger Bands; a good sign.

F – Here’s where it gets tricky. I like to see price close inside the lowest Fib range and it has. I also like to see a move to the upside to confirm a potential reversal and the last candle has done that. However, the last candle is a spinning top that is almost a doji. This usually indicates a change in direction from the previous move. So we may see price drop to the 0% Fib level. I’m guessing it won’t and here’s why.

Point F also shows a slight breakout from a bull wedge which is highlighted by the dark green lines. Now, referring back to my comment in the B’s about 3 attempts to the upside, here we only see 2 attempts UNLESS you count the top of the lowest candle on 10oct2024.

Also, experience has seen many reversals triggered when only halfway down this Fib level.

Red Dotted Line – Bid price 2 cents above the “valley high”.

Green Dotted Line – This Ask price is for first-time buyers of this stock and at this position. This Ask is based on my own calculation reviewed in every newsletter and may not be there right Ask price for you at your commission structure.

Black Dotted Line – Assuming we buy the same number of shares on Monday that were bought on 02oct2024 (brown vertical line), $7.03 will be the new sell price.

Solid Brown Lines – The first buy date (vertical), buy ($7.01 horizontal) and ask ($7.40 horizontal) lines.

Light Blue Price Range Tool – Note that this is down $1.17. This shows an area that I feel is good for the Add-on buy (see GROUND RULES for important disclaimer here). I’m most comfortable add-on bidding at 3 times my potential gain.

So here the gain is 7.40 - 7.01 = 39 cents per share.

0.39 x 3 = 1.17

With the first add-on, this usually sees my new sell price landing around the original buy price. In this case, the Ask will be $7.03

G – The Keltner has also broken down through the upper BolBand. Another good sign.

H – A slight increase in Volume but mostly a “meh” factor here.

I – RSI is starting to make a move above the 20. Is bueno!

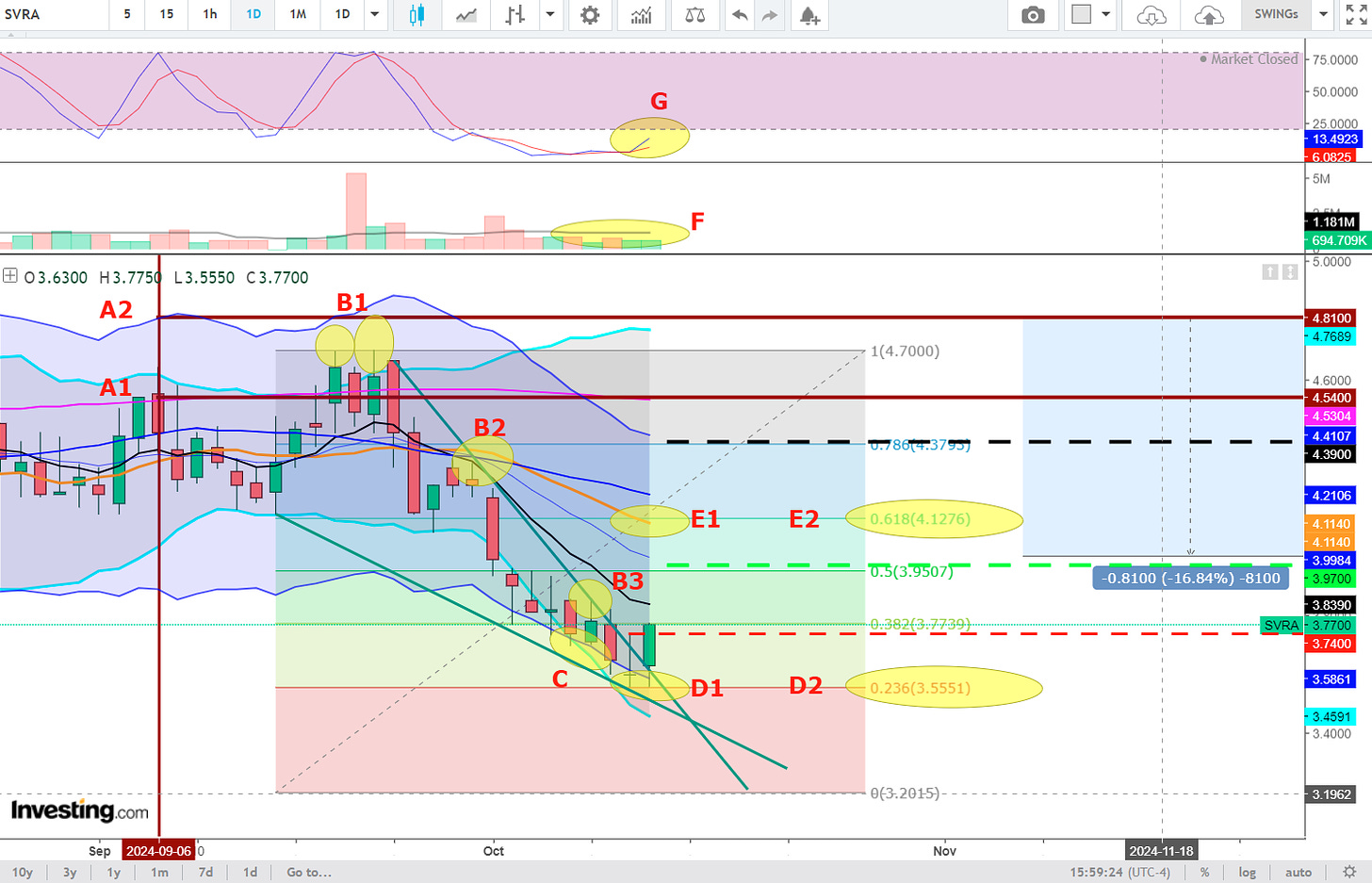

Now let’s look at SVRA. It may bounce to test the Golden Ratio. For this reason, it’s almost a carbon copy of NUS.

A1, A2 – Bid (buy) and Ask from06sep2024. (Straight brown lines)

B1, B2, B3 – B1 shows a double top which is often an indicator that a downtrend may follow. B2 is the second attempt to pass through the dark green trend line. It’s also a major event cluster and is checking resistance against the 10 ema (exponential moving average – black line), the 20 sma (orange line) and the 50 sma (dark blue line). This is all happening near a Fib level. B3 indicates the 3rd touch.

C – Once again we see the Kelt crossing the BolBand and a pause around a Fib level, but this time it’s the 38.2% level. Higher than I typically prefer so this trade, in my opinion, has a touch more risk. That said…

D1, D2 – … indicate a potential double bottom reversal at the 23.6% Fib level. It includes a doji as the second last candle. Again, doji’s often represent a “tie” between the bulls and the bears and often precede a reversal. Price action has a habit of bouncing off the 38.2% level or the 23.6% level to test the 61.8% level for resistance. So this is what I’m counting on.

E1, E2 – In this case, this level is not only the Golden Ratio for Fibonacci, but is also bound to be the event convergence of the 20 sma (orange line) or the 50 sma (dark blue line).

Another very possible resistance level is the green candle before B2. It shows convergence at the bottom of the green candle tail that also touches the ice blue line representing the lower Bollinger Band.

Dark Green Lines – Again, they shape a Bull Wedge.

Red Dotted Line – Bid price.

Green Dotted Line – Ask price for those who are buying SVRA for the first time and using my sell calculation.

Black Dotted Line – Ask price for those buying for a second time at the same number of shares as the 06sep2024 buy.

CONUNDRUM – My sell price (black dotted line) is actually ABOVE where I think the price action will go (E1, E2 target). If D1 is actually the bottom of bottoms, price action could very well head for the Keltner Channel’s top border which is close to converging with Fib level 78.6% AND my revised Ask (black dotted line). If not, I may face another buy in the weeks to come. No big deal, just more time and capital averaging down. Some people snap at this, but if your contributing monthly to a mutual fund through your Financial Advisor or on your own, you’re doing this regularly as “Dollar Cost Averaging”.

F, G – same as NUS stock

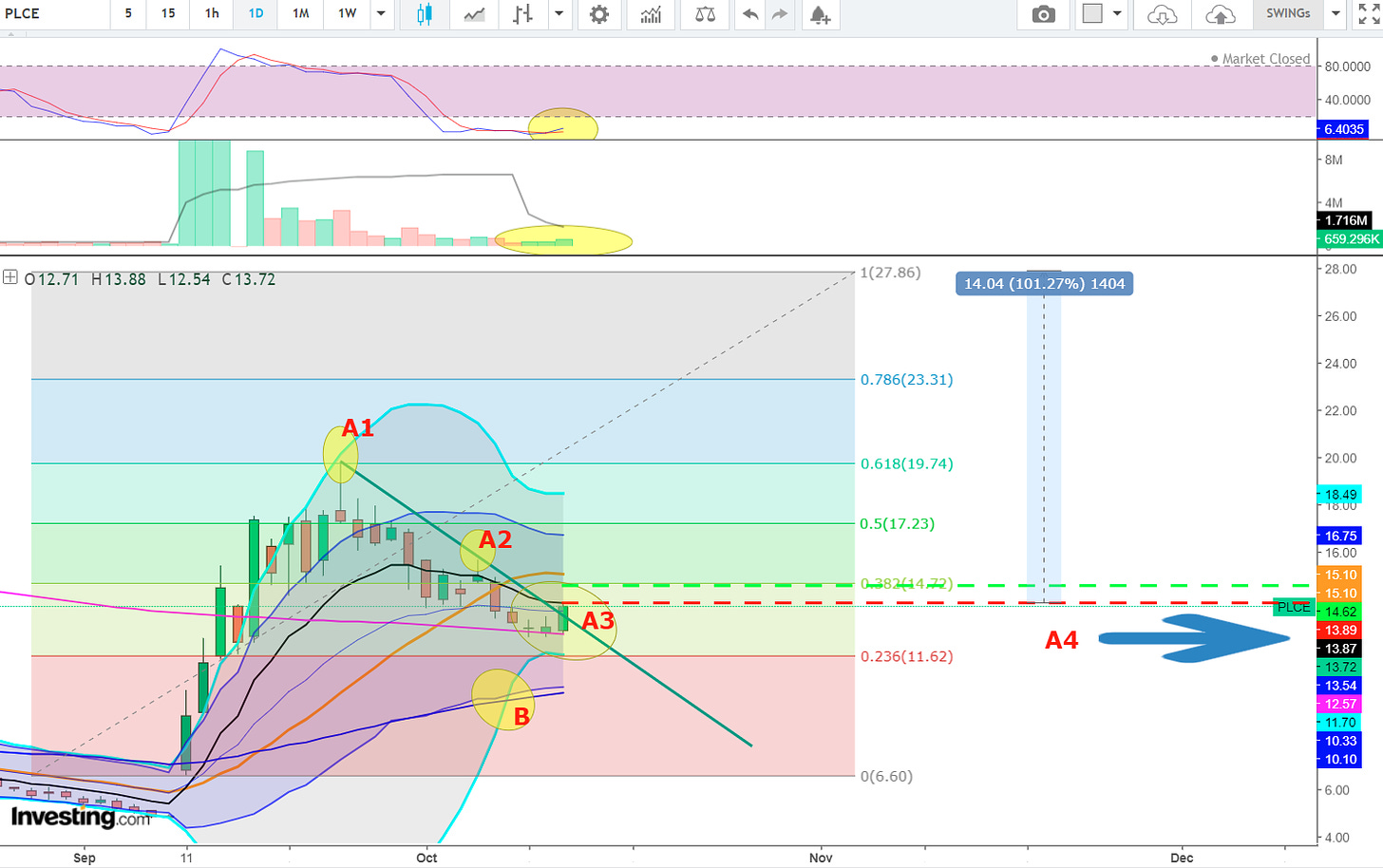

And finally, PLCE. This is another potential bounce play but in an uptrend.

Here we’re counting on a bounce back up to A1’s Golden Ratio level IF this is truly going to be a long-term continuation play. My 5% target (green dotted line) is at a Fib level that is about to converge with the 20 sma (orange line). For those who will risk holding this for several weeks (not typically swing traders) you may actually double your money. No guarantees, especially since earnings are currently expected mid to late November.

BID PRICE – In this case, the closing price has not rested above the nearest price average line (here it’s the 10 ema – black line). I will put my entry bid above that indicator to provide me some proof that the action may intend to proceed upwards.

Note the arrow at A4. It points to the 10 ema (black box) at 13.87, so I’m setting my Bid at 13.89 (red box).

ASK PRICE - If price moves above the 10 ema, there is a very, very strong chance buyers will want to test the 20 sma which is well above my Ask price. Also note my Ask is just below the 38.2% Fib level - another magnet for price action. If I’d set my bid much higher, I risk not being able to quickly sell within the parameters I follow.

Here’s wishing you the best of bidding and success in selling!

BTW…

10 positions sold this week. [Scroll down to “SELLS THIS WEEK”.]

17 positions were expanded or started this week.

{ssd} = sold-same-day at a minimum 5% gain (unless otherwise noted)

Bids that filled today, 11oct2024: AMTX, BCDA, CGC, GOVX, TSE

Today’s bids sold before 14oct2024: nil

Check each Weekend Edition where you will find the details of each week’s sells. Our Daily Edition will continue to produce bid lists for you.

See below for all the bids that filled and the new bids available to you when you “play along at home”!

Personal Stats Update

You may (and should) find your numbers are better than this as my calculations include pre-Feb 2024 phases of experimentation that Substack readers haven’t participated in.

LONG TERM AVG TRADE DAY GAIN ON SELLS vs AVG TRADE DAY BALANCE

0.34 %

PROJECTED AVG ANNUAL COMPOUNDED RETURN

136.51 %

AVG % OF BIDS THAT FILL EACH TRADING DAY

37.09 %

PERSONAL SELLS SINCE 4DEC2024 (including losses)

611

AVG SELLS PER DAY ON PERSONAL POSITIONS

2.8

LONG TERM AVG RETURN PER SELL (including losses)

7.24 %

AVG NUMBER DAYS TO SELL

12.5 DAYS

POSITIONS IN PLAY AT CLOSE OF WEEK

56

On average, about 55.6% of my buys sell in less than a week, and about 44.4% sell in more than 7 calendar days. You may (and should) find your numbers are better than this as my calculations include pre-20feb2024 phases of experimentation that Substack readers haven’t participated in.

Since 4dec2023, I’ve profited 73% against my daily average balance.

There are about 252 trading days per year.

Any sells mentioned herein profited AT LEAST 5% after commissions (unless otherwise noted).

SELLS THIS WEEK – Average personal gains per sell this week = 5.32 %

{ssd} = sold-same-day at a minimum 5% gain (unless otherwise noted)

07oct2024

Personal sells from cited bid lists:

- PTEN - 24sep2024; 01oct2024

Participating subscriber sells from cited bid lists:

- Same, plus

- JDST – 04oct2024

- LAC – 20jun2024; 25jun2024; 22jul202421aug2024; 17sep2024;

08oct2024

Personal sells from cited bid lists:

- nil

Participating subscriber sells from cited bid lists:

- NMHI – 15aug2024

09oct2024

Personal sells from cited bid lists:

- CERS – 27sep2024; 04oct2024

Participating subscriber sells from cited bid lists:

- Same

10oct2024

Personal sells from cited bid lists:

- nil

Participating subscriber sells from cited bid lists:

- Same

11oct2024

Personal sells from cited bid lists:

- WOLF – 08oct2024

- NG – 10oct2024

- TSE {ssd}

- GTB – 10oct2024

Participating subscriber sells from cited bid lists:

- Same, plus…

- VSTM – 13 & 29aug2024; 18sep2024

My 5% gain + expenses may be different than yours as I pay 1 cent per share commission (both ways) and I allow another penny for miscellaneous account expenses and rounding. Thus, a $3.00 BUY will actually sell for:

($3.00 x 1.05) + $0.04 = $3.15 + $0.04 = $3.19

Monday’s Bids!

14-Oct-24

COTY

9.21

CRDF

2.63

ESPR

1.93

EYPT

8.92

FCEL

0.34

GOGO

6.59

GREE

2.05

GTN

5.45

IMMR

8.39

IOVA

9.51

LAB

1.79

LDTC

0.275

LFMD

4.47

NMHI

0.185

NUS

6.28

PLCE

13.89

PLUG

2.14

SDIG

4.32

SVRA

3.74

TSE

6.39

UMC

8.07

Please review these ground rules regularly:

Remember, these BIDS are entered as STOP LIMIT – DAY

and ASKS are LIMIT – GTC (Good Till Cancel)

For money management safety, never put more than 2% of your DAILY net equity balance into any one position. (Some exceptions apply. See below). You will have more flexibility and be even more comfortable with 1% or less as a position size. THIS IS TOTALLY YOUR DECISION.

I’ve actually switched my money management to allow me to bid on all the daily bid lists published herein. I only use 25% of my Buying Power (BP) each morning, divided by the number of bids. Thus, if you have $1,000 of BP, you will only use $250 for that day’s bidding. If you fill 40% ($100) of your bids that day, the next day your buying power might be about $900, ($1,000 less the $100 you actually spent the day before). This way your typically able to play every single bid, every day. Ultimately, it may take some time to find what works best for you.

You can bid on all stocks on the bid lists, even if you already own them, and PROVIDING the potential negative effects of your broker’s commission structure makes it logical and profitable for you to do so.

You may prefer an approach of always buying the same NUMBER of shares when you add to a position. For instance, if you buy 2 lots (200 shares) of a stock at $4, and that stock goes down in price, then when that stock shows on my bid list again, you could buy another 2 lots at the lower price. Just make sure your approach drops your Asking price a healthy amount.

I don’t use stops. That said, it’s important to realize that this is a very contrarian view compared to most of the industry. I average down in a strictly controlled method as noted above.

Here’s to your good health, life balance and prosperous week!

Brian

Personal and New Subscriber BUY/SELL HISTORY

{ssd} = sold-same-day at a minimum 5% gain (unless otherwise noted)

Bids that filled today, 11oct2024: AMTX, BCDA, CGC, GOVX, TSE

Today’s bids sold before 14oct2024: nil

Bids that filled today, 09oct2024: nil (I know. Unbelievable.)

Today’s bids sold before 10oct2024: nil

Bids that filled today, 08oct2024: CHRS, IDAI, WOLF

Today’s bids sold before 09oct2024: nil

Bids that filled today, 07oct2024: CHGG

Today’s bids sold before 08oct2024: nil

Bids that filled today, 04oct2024: CERS, CGC, JDST, KOSS, PERI

Today’s bids sold before 07oct2024: nil

Bids that filled today, 03oct2024: AXL, EYPT

Today’s bids sold before 04oct2024: nil

Bids that filled today, 02oct2024: BTAI, NUS

Today’s bids sold before 03oct2024: nil

Bids that filled today, 01oct2024: CATX, PTEN

Today’s bids sold before 02oct2024: nil

Bids that filled today, 30sep2024: CATX, CGC, IRWD, LXRX, OIS, TBLA

Today’s bids sold before 01oct2024: CATX {ssd}, CGC {ssd},

Bids that filled today, 27sep2024: ABAT, CERS, LGHL, PERI, SAVE

Today’s bids sold before 30sep2024: ABAT {ssd},

Bids that filled today, 26sep2024: ESPR

Today’s bids sold before 27sep2024: nil

Bids that filled today, 25sep2024: AMTX, BHC, BLDP, NAT, UGP

Today’s bids sold before 26sep2024: nil

Bids that filled today, 24sep2024: AMPX, CHRS, COTY, GOGO, OIS, PTEN, RIG, WOLF

Today’s bids sold before 25sep2024: nil

Bids that filled today, 23sep2024: AG, RIOT

Today’s bids sold before 24sep2024: nil

Bids that filled today, 20sep2024: CUTR, EKSO, LDTC

Today’s bids sold before 23sep2024: nil

Bids that filled today, 19sep2024: AAOI, BTAI, CCLD, NCL, PLCE, POWW

Today’s bids sold before 20sep2024: PLCE {ssd},

Bids that filled today, 18sep2024: CATX, CRDF, FCEL, IRWD, MUX, NUZE, SDIG, SURG, TSE, VSTM

Today’s bids sold before 19sep2024: nil

Bids that filled today, 17sep2024: AMPX, CHGG, PLCE, LAC, LPTV, NXE, XTIA

Today’s bids sold before 18sep2024: PLCE {ssd}

Bids that filled today, 16sep2024: BLDP

Today’s bids sold before 17sep2024: nil

that filled today, 13sep2024: CGC, COTY

Today’s bids sold before 16sep2024: nil

Bids that filled today, 12sep2024: CCLD, EYPT, FCEL, GTN, LDTC, TTI, WB, XXII

Today’s bids sold before 16sep2024: CCLD, EYPT {ssd}, GTN, XXII

Bids that filled today, 11sep2024: AG, IDAI, MUX, NXE, RAPT, SAVE, SSYS, TSE

Today’s bids sold before 16sep2024: AG {ssd}, SSYS {ssd}, TSE

Bids that filled today, 10sep2024: AMTX, SDIG

Today’s bids sold before 11sep2024: nil

Bids that filled today, 09sep2024: BLDP, IPA, LAB, NUZE

Today’s bids sold before 10sep2024: nil

Bids filled 06sep2024: IOVA, NWL, RIG, RVSN, SVRA, UGP

Sold before 09sep2024: nil

Bids filled 05sep2024: nil

Sold before 06sep2024: nil

Bids filled 04sep2024: nil

Sold before 05sep2024: nil

Bids filled 03sep2024: BHC, CGC, OSUR, SSYS

Sold before 04sep2024: nil

Bids filled 30aug2024: CX, EKSO, NUZE, XPER

Sold before 03sep2024: NUZE {ssd}

Bids filled 29aug2024: AXL, IPA, LAAC, POWW, UMC, VSTM

Sold before 30aug2024: nil

Bids filled 28aug2024: NWL

Sold before 29aug2024: nil

Bids filled 27aug2024: LDTC, NUZE, SWN

Sold before 28aug2024: NUZE

Bids filled 26aug2024: BLDP, BTAI, LDTC, LFMD, PLCE, RAPT

Sold before 27aug2024: nil

Bids filled 23aug2024: ABEV, LAB, OIS

Sold before 26aug2024: LAB {ssd}

Bids filled 22aug2024: CUTR, POAI, TTI

Sold before 23aug2024: nil

Bids filled 21aug2024: ACET, JDST, LAC, PSEC

Sold before 22aug2024: nil

Bids filled 20aug2024: CX, IOVA, SDIG

Sold before 22aug2024: IOVA, SDIG

Bought 19aug2024 & all SOLD before 23aug2024: SPWH

Bids filled 16aug2024: CATX, CRDF, LAB, LDTC, TNON, TSE

Sold before 22aug2024: CATX, LAB, LDTC {ssd}, TNON, TSE {ssd)

Bids filled 15aug2024: CRDF, NMHI, WB

Sold before 16aug2024: CRDF {ssd}

Bids filled 14aug2024: CCLD, FCEL, LGHL, LPTV, OSUR

Sold before 24aug2024: CCLD, FCEL, OSUR,

Bids filled 13aug2024: RIG, RVSN, VSTM

Sold before 14aug2024: nil

Bids filled 12aug2024: CCLD, UMC, XTIA

Sold before 22aug2024: UMC

Bought 9aug2024 & all SOLD before 23aug2024: POWW

Bought 8aug2024 & all SOLD before 9aug2024: LFMD

Bids filled 07aug2024: AMTX, CHGG, LAB

Sold before 08aug2024: nil

Bids filled 06aug2024: nil

Sold before 07aug2024: nil

Bought 5aug2024 & all SOLD before 8aug2024: AAOI, RIG

Bids filled 2aug2024: CCLD, SSYS, SURG

Sold before 8aug2024: CCLD

Bids filled 01aug2024: AXL, BTAI, CGC, ENSC, LDTC, LFMD, MPW

Sold before 28aug2024: ENSC

Bids filled 31jul2024: nil

Sold before 01aug2024: nil

Bids filled 30jul2024: COTY, POAI

Sold before 31jul2024: nil

Bids filled 29jul2024: CGC, CHGG, IOVA, RVSN, WB, XPER, XTIA

Sold before 31jul2024: CGC, IOVA

Bids filled 26jul2024: AMTX, CCLD, EYPT, POWW, SPWH, TNON

Sold before 30jul2024: CCLD, EYPT,

Bids filled 25jul2024: ESPR, NWL

Sold before 27jul2024: NWL

Bids filled 24jul2024: LAAC, LFMD, SPWH

Sold before 01aug2024: LFMD, SPWH

Bids filled 23jul2024: AAOI, ABEV, CHGG, CRDF, CX, IOVA, LPTV

Sold before 22aug2024: AAOI, ABEV, CHGG, CRDF, IOVA

Bids filled 22jul2024: LAC, NXE, TBLA, UGP, VSTM

Sold before 23jul2024: nil

Bought 19jul 2024: BTAI, CHRS, NCL, POWW

Sold before 26jul2024: POWW

Bids filled 18jul2024: GOGO, LFMD, PERI, POAI, SWN, TWOU

Sold before 26jul2024: LFMD, POAI

Bids filled 17jul2024: ASTR, SURG, TWOU

Sold before 18jul2024: TWOU {ssd}

Bids filled 16jul2024: ABAT, BTAI, IRWD, LGHL, SYBX

Sold before 17jul2024: BTAI {ssd}, IRWD {ssd}, SYBX {ssd}

Bids filled 15jul2024: IDAI, LPTV, OSUR

Sold before 12aug2024: OSUR

Bought 12jul 2024: BGS, CHGG, NCL, OIS, RVSN, SYBX, XTIA

Sold before 15jul2024: BGS, RVSN {SSD}

Bought 11jul 2024: ASTR, MVIS, SYBX, TTI, VERU

Sold before 12aug2024: MVIS, TTI, VERU

Bought 10jul 2024: BLDP, IOVA, SAVE, SURG

Sold before 15jul2024: BLDP, IOVA, SURG

Bought 09jul 2024: AUGX, HNRG, LDTC, TWOU

Sold before 12jul2024: HNRG, TWOU {ssd}

Bought 08jul2024 & ALL SOLD before 15jul2024: ARCO, CATX, EKSO, EYPT, FATE

Bought 05jul 2024: BIG, NMHI, VERU

Sold before 15jul2024: BIG {ssd} at loss, VERU

Bought 03jul2024 & ALL SOLD before 11jul2024: PACB

Bought 02jul2024 & all SOLD before 28aug2024: ENSC

Bought 01jul 2024: BGS, CATX, IOVA, CHRS, LGHL, TTI, XTIA

Sold before 12aug2024: BGS, IOVA

Bought 28jun2024: BLDP, CHGG, CHRS, IOVA, PACB, SIRI, TTI, VERU

Sold before 12jul2024: BLDP, IOVA, SIRI, TTI

Bought 27jun2024: IRWD, MVIS, ORGO, SSP

Sold before 15jul2024: IRWD, MVIS

Bought 26jun2024: JDST

Sold before 27jun2024: nil

Bought 25jun2024: LAB, LAC, RVSN, XXII

Sold before 12jul2024: LAB, XXII

Bought 24jun2024: PACB, RIG, SAVE, SIRI, XAIR

Sold before 03jul2024: SIRI, XAIR {ssd}

Buys for 21jun2024: LAB, MRIN, SDIG, LDTC

Sold before 15jul2024: LAB, LDTC, SDIG {ssd}

Bought 20jun2024: AUGX, BGS, LAC, NCL, RIG, WRAP, MRIN

Sold before 26jun2024: AUGX, BGS, WRAP

Bought 18jun2024: APPS, BTE, ENSC, GTN, SSP, TBLA, TTI

Sold before 28aug2024: APPS, ENSC, TTI

Bought 17jun 2024: ACET, AMPX, BB, SIRI, XTIA, XXII

Sold before 3jul2024: ACET, AMPX, BB, SIRI, XXII

Bought 14jun 2024: ASTR, IRWD

Sold before 17jun2024: nil

Bought 13jun 2024 & ALL SOLD before 22jun2024: KAVL, WRAP

Bought 12jun 2024: BTAI, DBI, IOVA, LAC, LGHL, OSUR, TNON, TWOU

Sold before 12aug2024: DBI, IOVA, OSUR, TNON

Bought 11jun 2024: AEMD, LPTV

Sold before 13jun2024: AEMD

Bought 10jun 2024 & ALL SOLD before 03jul2024: AUGX, SIRI

Bought 07jun 2024: ABAT, BLDP, EKSO, IRWD, RVSN

Sold before 30jul2024: EKSO

Bought 06jun 2024: AMPX, AMTX, ASTR, EYPT, IDAI, IPA, ORGO, PCSA, RIOT, SDIG

Sold before 12jul2024: AMPX, AMTX, EYPT, ORGO, PCSA, RIOT, SDIG

Bought 05jun 2024: ARCO, CHRS, RVYL, TGB

Sold before 20jun2024: RVYL, TGB

Bought 04jun 2024: HPP, KAVL, KPTI, MD, NCL, PCSA, RIG, VERU, WULF

Sold before 20jun2024: HPP, KAVL, KPTI, MD, PCSA, WULF

Bought 03jun 2024: BGS, CATX, EGY, REVB, SIRI, TTI, TWOU, YANG

Sold before 12aug2024: BGS, EGY, REVB, SIRI, TTI, YANG

Bought 31may2024: APPS, FATE, LAC, XXII

Sold before 15jul2024: APPS {ssd}, XXII

Bought 30may2024: CHGG, GTBP, SYBX, XTIA

Sold before 5jun2024: GTBP, XTIA

Bought 29may2024 & all SOLD before 28aug2024: ATCH, ENSC

Bought 28may2024: ASTR, LGHL, NMHI, SSP, WULF

Sold before 31may2024: SSP, WULF

Bought 24may2024: NVFY, SYBX

Sold before 6jun2024: NVFY

Bought 23may2024: BIG, FATE, GREE, IPA, JDST, MGNX, RVNC, RVYL, SSP, WRAP, XTIA

Sold before 28jun2024: BIG, GREE, MGNX, RVNC, RVYL, SSP, WRAP, XTIA

Bought 22may2024: CLNE, HBI, IRWD, LAB, PACB, PRSO, WRAP, ZYME

Sold before 21jun2024: CLNE, HBI, PRSO, WRAP, ZYME

Bought 21may2024: DDD, FATE, HIVE, IPA, MGNX, MVIS, REVB, TWOU

Sold before 7jun2024: DDD, HIVE, MGNX, MVIS, REVB

Bought 17may2024: BTAI, CLNE, LDTC, TWOU, ZYME

Sold before 31may2024: CLNE, LDTC, ZYME

Bought 16may2024: APPS, BLDP, CLNE, DDD, ESPR, FATE, LAB, LAC, LXRX, OIS, ORGO, PACB, PRSO, REVB, RGLS, SAVE, TNON, XAIR

Sold before 15jul2024: APPS, CLNE, DDD, ESPR {ssd}, LAB, ORGO, REVB, RGLS, XAIR {ssd}

Bought 15may2024: APLD, AXTI, BLDP, CLNE, COMM, DDD, DHC, FATE, IPA, PACB, REVB, RVYL, SURG, TBLA

Sold before 11jun2024: APLD, AXTI, CLNE, COMM, DDD, DHC, REVB, RVYL

Bought 14may2024: APLD, COMM, ESPR, FATE, PRSO, RVYL, SSP, TBLA, TTI

Sold before 11jun2024: APLD {ssd}, COMM, ESPR, RVYL, TTI

Bought 13may2024: DDD, DHC, FATE, HKD, LDTC, LXRX, PCSA, PLUG, SURG, SSP

Sold before 14may2024: FATE {ssd}, LDTC, LXRX, PLUG {ssd}, SSP {ssd}

Bought 10may2024: BIG, BLDP, BPTH, BTAI, CHRS, COMM, DHC, LXRX, PACB, PLUG, SIRI, SPWR, SURG, TTI

Sold before 12aug2024: BIG, BPTH, COMM, LXRX, PACB {SSD}, PLUG, TTI

Bought 09may2024: AMTX, APLD, BLDP, ESPR, HIVE, LDTC, MNKD, OIS, SPWR, TWOU

Sold before 21may2024: APLD, BLDP, ESPR, HIVE, LDTC, MNKD, SPWR

Bought 08may2024: AMC, BTAI, DDD, FCEL, IRWD, RVYL, SLRN, WW

Sold before 11jun2024: AMC, DDD, RVYL, SLRN {ssd}, WW

Bought 07may2024: APPS, DDD, FATE, JDST, LAZR, PLUG, SLRN, SURG, WW

Sold before 14may2024: APPS, DDD, FATE, PLUG, SLRN {ssd}, LAZR, WW

Bought 06may2024: ABAT, APLD, ATGL, BPTH, ESPR, FATE, GREE, PCSA, RVNC, SLRN, UK

Sold before 14may2024: APLD, ATGL, BPTH, ESPR, FATE, PCSA {ssd}, RVNC, SLRN {ssd}, UK

Bought 03may2024: BIG, EGHT, HIVE, LXRX, SAVE, SIRI, ABAT, ASTR, ATGL, IRWD, RVYL, SURG, XAIR

Sold before 24jun2024: ATGL, BIG, HIVE, LXRX {ssd}, RVYL, SAVE, SURG, XAIR

Bought 02may2024: FATE, OIS, RVNC, SPWR, VTNR, ORGO, REVB, TNON, ZYME

Sold before 12jun2024: FATE, ORGO, REVB, RVNC, SPWR, VTNR, ZYME

Bought 01may2024 & all SOLD before 14may2024: AVXL, BCRX {ssd}, CLNE, DHC, ESPR, PACB,

Bought 30apr2024 & all SOLD before 06may2024: APPS, AXTI, CLRB, LUNA, NVAX, RVNC

Bought 29apr2024 & all SOLD before 14may2024: AXTI, BLNK, LXRX, MNKD, PACB {ssd}, PRSO, PXLW, VNET {ssd}

Bought 26apr2024: IMTE, IPA, LDTC, RDFN, TUP,

Sold before 21may2024: IMTE {SSD}, LDTC, RDFN, TUP

Bought 25apr2024 & all SOLD before 24may2024: RMCO

Bought 24apr2024: RVYL, CCO, CHRS, CIM, CYH, JMIA, LAZR, NIO, SIRI

Sold before 12jul2024: CCO, CYH, NIO,

Bought 23apr2024: NMHI, CVAC, RAPT, EB, AMC, APLD, APPS, JDST, OPI, TIGR, XTIA

Sold before 03may2024: AMC, APLD {ssd}, APPS {ssd}, CVAC, EB, OPI, RAPT, TIGR

Bought 22apr2024: AMCX, IRWD, NMHI, TBLA, MOMO

Sold before 02may2024: AMCX, IRWD, TBLA, MOMO

Bought 19apr2024 & all SOLD before 30apr2024: LX, PACB {ssd}

Bought 18apr2024: ACET, ANY, BBLG, BZUN, CUTR, FUBO, FUFU, GREE, GTN, HOUS, ILAG, LCID, PTN, SSRM, TWKS

Sold before 6may2024: ANY, BBLG {ssd}, BZUN, CUTR, FUBO, GREE, GTN, HOUS, ILAG, LCID, SSRM, TWKS

Bought 17apr2024: ASTR, AUPH, BCRX, BTAI, HNRG, NAT, OMER, SDIG, XAIR

Sold before 24jun2024: ASTR, BTAI, HNRG, SDIG, XAIR

Bought 16apr2024 & all SOLD before 22apr2024: AEHL, ORGO, TTOO

Bought 15apr2024: BTAI, WW, XTIA

Sold before 3may2024: WW, XTIA {ssd}

Bought 12apr2024: BCRX, BTAI, OPI, ORGO

Sold before 13may2024: BTAI {ssd}, ORGO

Bought 11apr2024: ABAT, APYX, BQ, CUTR, CVAC, FCEL, FUBO, OPI, SYRA, TIGR, ZIM

Sold before 13may2024: APYX, BQ, CVAC, CUTR {ssd}, OPI {ssd}, SYRA, TIGR, ZIM

Bought 10apr2024: NMHI, SAVE, SURG, TTOO

Sold before 14may2024: SAVE, SURG, NMHI {ssd}, TTOO

Bought 09apr2024 & all SOLD before 06may2024: EB, OMER, TIGR, WW {ssd}

Bought 08apr2024: AHT, CUTR, HNRG, LAZR, LPTX, PALT, TSE

Sold before 15apr2024: AHT, CUTR, HNRG, LPTX, PALT

Bought 05apr2024: APYX, IRBT, WRAP, TENX, CASI, UK

Sold before 13may2024: APYX, IRBT {ssd}, UK

Bought 04apr2024: AEHL, LDTC, NMHI, REVB, SQNS, SYRS, XAIR, ZYME

Sold before 12jun2024: AEHL, LDTC, NMHI, REVB, SQNS {ssd}, SYRS, ZYME

Bought 03apr2024: LUNA, MLGO, RVSN

Sold before 15apr2024: RVSN

Bought 02apr2024: APYX, CULP, ENSC, IMTE, TNON

Sold before 13may2024: APYX, ENSC,

Bought 01apr2024: AJX, BBLG, CUTR, IDAI, LPTV, MSGM, NERV

Sold before 15apr2024: IDAI, CUTR, MSGM

Bought 28mar2024: AMPX, CMTL, CUTR, GFAI, GREE, GRYP, IPA, IRBT, IRWD, SDIG, RDFN, REBN, SYBX

Sold before 23apr2024: CUTR {ssd}, GFAI, GRYP, IRBT, SDIG {ssd}, SYBX, RDFN {ssd}, REBN {ssd}

Bought 27mar2024: IHRT, NMHI, SSRM, TTOO, WRAP, ZJYL

Sold before 15apr2024: IHRT {ssd}, SSRM, TTOO {ssd}, WRAP {ssd}, ZJYL

Bought 26mar2024: AMCX, CASI, DBGI, RVSN

Sold before 14may2024: AMCX, CASI, DBGI

Bought 25mar2024: BTCS, BQ, IMTE, MLGO, REKR, VERO, VRM

Sold before 30apr2024: BTCS {ssd}, BQ, IMTE, REKR, VERO, VRM {ssd}

Bought 22mar2024: BACK, CVAC, LUNR, MSGM

Sold before 06may2024: BACK {ssd}, CVAC, LUNR {ssd}

Bought 21mar2024: HROW, LCID, REBN, SURG, TNON, VIEW, ZIM, ZJYL

Sold before 15apr2024: HROW, LCID, REBN {ssd}, SURG, VIEW, ZIM, ZJYL {ssd}

Bought 20mar2024: ACHL, AEHL, ATGL, CONN, FUBO, FUFU, IMMX, PLCE, QS, RAPT, REKR, RMCO, STEM, TWOU, UIS, UK, YOSH

Sold before 03may2024: ACHL, AEHL, ATGL, CONN {ssd}, IMMX, QS, RAPT, REKR, RMCO, STEM, UIS, YOSH {ssd}

Bought 19mar2024: DBGI, EKSO, FET, OVID, SPRC, ZCAR

Sold before 30jul2024: DBGI, EKSO, FET, OVID, SPRC {ssd}

Bought 18mar2024: APYX, CKPT, EFSH, FSLY, IVDA, NKLA, NOVA, OCG, ONDS, OPEN, OUST, PHAT, PRME, TTOO, UPLD, VOR

Sold before 13may2024: APYX, CKPT, EFSH, IVDA, NKLA, NOVA, ONDS, OPEN {ssd}, OUST, PHAT, UPLD, VOR

Bought 15mar2024: AMRX, BIOR, BTDR, CLEU, GREE, HEPA, LGHL

Sold before 15apr2024: AMRX, BIOR, BTDR {ssd}, CLEU, GREE, HEPA,

Bought 14mar2024: AKA, KITT, LPSN

Sold before 15apr2024: AKA {ssd}, KITT {ssd}

Bought 13mar2024: AAN, ASLE, AUR, CEPU, HKD, IDAI, RDI, RIOT

Sold before 15apr2024: AAN, ASLE, AUR, CEPU, IDAI {ssd}, RIOT,

Bought 12mar2024: ACU, ASTR, BTOG, EBIXQ, GENK, JOAN, UP, TOI, ZCMD

Sold before 15apr2024: ACU, ASTR, BTOG, EBIXQ, GENK, JOAN (bankrupt 05mar2024), UP, TOI, ZCMD (could have played it twice)

Bought 11mar2024: AEI, AUTL, ATGL, DAVA, IRWD, SQNS, ZIM

Sold before 21may2024: AEI, AUTL, ATGL, DAVA, SQNS, ZIM

Bought 08mar2024: BACK, BBLG, IRBT, LPTX, PCT, REVB, TBLA, TLRY, TWKS, WRAP, XAIR

Sold before 24jun2024: BACK, BBLG, IRBT, LPTX, PCT, REVB, TLRY, TWKS, WRAP, XAIR

Bought 07mar2024: AADI, AMPX, EKSO, LDTC, LPTV, RMCO, RVSN, VERI

Sold before 30jul2024: AADI, AMPX, EKSO, LDTC, RMCO, RVSN, VERI

Bought 06mar2024: CETY, DTCK, FCEL, HOLO, NERV, REKR

Sold before 15apr2024: CETY, DTCK, HOLO, NERV, REKR

Bought 05mar2024 & all SOLD before 16apr2024: AAN, ALRN, AUUD, CYA, MINM {ssd}, SNAL, SQNS, WAVD

Bought 04mar2024 & all SOLD before 11jun2024: ANTE {ssd}, ATCH, BOF, FET, GFAI {ssd}, IBRX, RENB {ssd}, STI, VERO, YOSH

Bought 01mar2024: ALCE, AMBP, ATGL, BBLG, ILAG, LCID, LGHL, TWOU, UPXI

Sold before 08may2024: ALCE, AMBP, ATGL, BBLG {ssd}, ILAG, LCID, UPXI,

Bought 29feb2024: ACHR, AUUD, EGHT, PLUG, RIVN, RVSN, STGW, SXTC, SYBX, SYRA, TWKS, ZJYL

Sold before 08may2024: ACHR, AUUD {ssd}, EGHT, PLUG {ssd}, RIVN, RVSN {ssd}, STGW, SXTC, SYRA, TWKS, ZJYL

Bought 28feb2024 & all SOLD before 28aug2024: AMCX, ENSC, GATO, IMTE, JFBR, ONMD, PBYI, SDIG, SELX, SNTG, TLS

Bought 27feb2024: ADIL, ANTE, BELFB, BREA, CANOQ, EBIXQ, GRYP, HGAS, IDAI, LBBB (NMHI), OIS, PCT, RIVN, SLRN, SYRA

Sold before 24may2024: ADIL, ANTE, BELFB, BREA, CANOQ {ssd}, EBIXQ, GRYP {ssd}, HGAS, IDAI, NMHI, OIS, PCT, RIVN, SYRA {ssd}

Bought 26feb2024 & all SOLD* before 03may2024: BFX (*bankrupt 05mar2024), BSGM {ssd}, CHSN, CONN, GRYP {ssd}, IDAI {ssd}, RAPT, SLRN {ssd}, TRUP, UIS, VRM {ssd}

Bought 23feb2024 & all SOLD before 08mar2024: ALCE {ssd}, EBIXQ {ssd}, EDAP, FSR, GLRE, PLCE, RVSN {ssd}, SSRM, VRM {ssd}, WAVD {ssd}

Bought 22feb2024 & all SOLD before 01apr2024: AUR, BE, DBGI, EFSH {ssd}, GFAI, GLRE, HLF {ssd}, NKLA, OZ {ssd}, PRME, SOUN, TDS

Bought 21feb2024 & all SOLD before 19apr2024: AEHL, ANAB {ssd}, ENVB {ssd}, KUKE, MTC

Bought 20feb2024 & all SOLD before 17may2024: BQ, CRDL {ssd}, GMBL, GRYP {ssd}, HLF {ssd}, MSGM, PXDT {ssd}

Disclaimer

The contents of this newsletter are believed to be reliable, but the accuracy or completeness of any information contained herein is not guaranteed and members of Baker’s Stock Trading Aids shall not in any way be liable for any delay in keeping such information current. Members of Baker’s Stock Trading Aids specifically disclaim all warranties, express or implied.

Although Baker’s Stock Trading Aids believes that the information provided on these pages is accurate, it provides no warranty with respect thereto. The information may not be suitable for all persons; it should not be relied upon in connection with a particular investor's trading; and, is not intended to be, nor should be construed as, an offer, recommendation or solicitation. Baker’s Stock Trading Aids does not provide investment advice, but a record of potential and actual trades by the author. The information in this newsletter is not intended for persons who reside in jurisdictions where providing such information would violate the laws or regulations of such jurisdiction.

Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Baker’s Stock Trading Aids does not provide investment advice or recommendations regarding the purchase or sale of any securities or derivatives.