Hot bidding trend bumps-up projection of 12-month return to 47%!

And we’ve filled 591 Sells since January 1st at an average gain of 7.07% each!

Truncated email? You can click on "View entire message" and be able to view the entire post in your email app.

A big welcome to all our new subscribers!

This newsletter is for interested readers to follow my progress, learn a lot about swing trading at a comfortable pace, and be inspired to not fear stock trading as a hobby or career (as I used to fear it for decades).

If you like the Baker Stock Trading Aids (BSTA) approach you can take a few minutes each weekday (typically within 6 hours of the market open at 9:30 am New York time) and, if you so choose, enter my bids and play my strategy as your own in your personal trading account. Usually, you only need 10-20 minutes daily just to enter your Bids. My research can save you hours of research time and potentially see you profit far above the market returns. (See POSITION CLOSURES section for my returns on a host of stocks. Also see the Disclaimer section.)

*******

Having issues with new terminology and concepts?

investopedia.com

is a GREAT resource I use regularly!

*******

A terrific week with 34 Sells from 39 Buys with average Gains per Sell of 7.51%!

The SPY was down ½% over the same period as the realities of the US/China deal proved to be no deal, and the Israel/Iran conflict heated-up. Oil had a big gain Friday due to the Middle East’s newest problems.

*******

BTCS calls for a slightly different Bid procedure. Here’s why.

Often, we prefer to see price moves from a high above the Bollinger Band (as shown at Point A) to a break-out below the Bottom Band or Keltner Channel (whichever is lower – KC at Point B in this case).

However, here we see a gradual 3-week decline featuring many red bars and some clear support and resistance at C1, C2, D1, and E1, E2. Focusing on E, we can see the support at the blue 50sma (simple moving average) aligning with the 23.6% level of the Fibonacci; this is often a sign that price will want to bounce-up to test Fib 38.2% (Point D2) to test the strength of the resistance (which is Point D1 previous support). Notice that the 10ema (exponential moving average – black line) will likely hit this Fibonacci level at the same time!

Now, where we would normally Bid 1 cent above the high ($2.26), would mean the Sell price based on our preferred calculation, would be $2.39. However, experience tells us that asking to sell at the same exact price of the previous support low (D1) could easily mean $2.39 gets hit, but the Ask may not fill. Selling at a lower price while still maintaining the target of 5% plus 2 cents, satisfies our rules.

So instead, we place a $2.19 Bid which is just above the previous close from Friday ($2.17). That way we can Ask (Sell) at $2.31, well below the likely $2.39 price test area. The yellow circles show areas where the ‘previous Close touch” has filled and moved.

One issue to be aware of is that price closed at the 200sma (pink line). Price may not move past this enough to reach my target. Chances are this is very unlikely to be an issue unless, perhaps, the broader markets open way down.

BTW…

Scroll on down to “SELLS THIS WEEK” and for recent updates.

{ssd} = sold-same-day at a minimum 5% gain (unless otherwise noted)

Bids that filled Friday, 13jun2025: nil

Today’s bids sold by 16jun2025: nil

The Weekend Edition provides the detailed summary of each week’s sells while the Daily Edition continues to produce new Bid Lists for you.

Scroll down for all the Bids that filled and the new Bids available to you when you “play along at home”!

*******

Personal Stats Update

You may find your numbers are better than this as some of my calculations include testing phases that don’t affect your numbers.

BASED ON TRADE DAYS YEAR-TO-DATE (Unless noted otherwise)

TRADE DAYS YTD

112

AVERAGE # of BIDS ACCEPTED (filled) PER TRADING DAY YTD

7 (52% of ALL BIDS)

AVERAGE # of BUYS PER SELL

1.3

AVERAGE # of SELLS PER TRADING DAY YTD (including losses, if any)

5.3

AVERAGE PROFIT PER SELL YTD (including losses, if any)

7.08 % (TARGET IS 5%)

PERSONAL SELLS YTD (including losses, if any)

591 SELLS from 746 BUYS

PERSONAL ASKS (ASKING PRICE TO SELL) CURRENTLY ON THE BOOKS

210

PROJECTED AVG ANNUAL COMPOUNDED RETURN (BASED ON AVERAGE SELLS PER TRADE DAY YTD)

47%

AVG NUMBER OF CALENDAR DAYS TO SELL EACH POSITION

23 DAYS

STOCKS IN PLAY AT CLOSE OF WEEK (personally held)

86

% of SELLS THAT OCCUR the SAME DAY THEY ARE PURCHASED

8.6 %

% of SELLS THAT OCCUR WITHIN A WEEK OF PURCHASE

47.9 %

% of SELLS THAT OCCUR MORE THAN 7 DAYS FROM PURCHASE

52.1 %

% of SELLS THAT OCCUR MORE THAN 30 DAYS FROM PURCHASE

23.5 %

NOTE: There are typically 252 trading days per year at the New York Stock Exchange.

*******

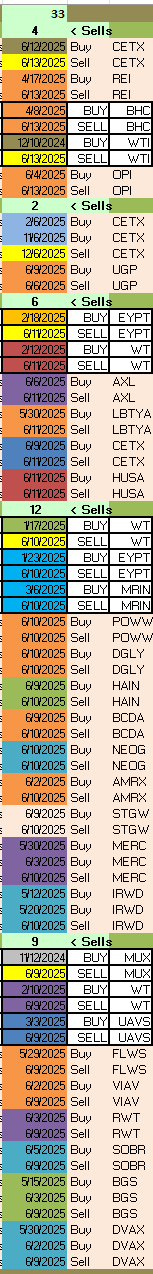

POSITION CLOSURES REPORTED OVER THE LAST 2 WEEKS

Any sells mentioned herein profited AT LEAST 5% after commissions (unless otherwise noted).

*******

SELLS UPDATED

7.51 % = Average personal profit per Sell for week

> Dividends NOT included <

34 Sells for the week, derived from 39 Buys

{ssd} = sold-same-day at a minimum 5% gain (unless otherwise noted)

ASK (aka SELL or TARGET) calculation:

My 5% gain + expenses may be different than yours as I pay 1 cent per share commission (both ways) and I allow 1 cent for miscellaneous account expenses and 1 cent for rounding. Thus, for my situation, a $3.00 Bid that fills as a Buy will actually sell for:

($3.00 x 1.05) + $0.04 = $3.15 + $0.04 = $3.19

***NEW!***

I’m gradually moving some new stock Bids that don’t have positions in my current provider, into a commission free provider. So, this calculation will be:

($3.00 x 1.05) + $0.02 = $3.15 + $0.02 = $3.17

Feel FREE when you Subscribe for FREE, tariff-FREE!

Monday’s Bids!

16-Jun-25

BTCS

2.18

CETX

1.04

CYH

3.24

MDXG

6.17

NEOG

5.68

SVRA

2.28

PLEASE REVIEW THESE GROUND RULES REGULARLY:

Remember, these BIDS are entered as STOP LIMIT – DAY

and ASKS are LIMIT – GTC (Good Till Cancel)

For money management safety, never put more than 1.5% of your DAILY net equity balance into any one position. (Some exceptions apply. See below). You will have more flexibility and be even more comfortable with 1% or less as a position size. THIS IS TOTALLY YOUR DECISION.

Another mode of money management is to only use 25% of your Buying Power (BP) each morning, divided by the number of bids. Thus, if you have $30,000 of BP and 10 bids on the list, you will only use $7,500 for that day’s bidding at $750 per position.

If you fill 40% ($3,000) of your bids that day, the next day your BP might be about $27,000, ($30,000 less the $3,000 you actually spent the day before). This way you’re typically able to play every single bid, every day. Ultimately, it may take some time to find what works best for you.

You may prefer an approach of always buying the same NUMBER of shares when you add to a position. For instance, if you buy 2 lots (200 shares) of a stock at $4, and that stock goes down in price, then when that stock shows on my bid list again, you could buy another 2 lots at the lower price on the bid list. Just make sure your approach drops your Ask price a healthy amount.

You can bid on all stocks on the bid lists, even if you already own them, and PROVIDING the potential negative effects of your broker’s commission structure makes it logical and profitable for you to do so.

You can also Ask with a sell price of:

- the average of your dollars/share (or “position”)

- times 105%

- plus, your expenses per share.

However, depending on your expense/commission structure, you may make more money faster by selling each Buy of a stock at its own target amount. This means more Asks on order, but that’s no big deal. It actually keeps more of your capital rotating through new Bids. Keep in mind that the Bids provided in the list are basically designed to Sell in the price range near my personal Ask (target) calculation.

I don’t use stops. That said, it’s important to realize that this is a very contrarian view compared to most of the industry. I average down in a strictly controlled method as noted above.

Have a great day!

Brian

The following is a list of filled Bids for 2025. For your own peace of mind, please use this along with the related stock charts to verify my reporting. Older Bids are listed in the final issues of 2024.

{ssd} = sold-same-day at a minimum 5% gain (unless otherwise noted)

Bids that filled Friday, 13jun2025: nil

Today’s bids sold by 16jun2025: nil

Bids that filled today, 12jun2025: CETX, OPI

Today’s bids sold by 13jun2025: nil

Bids that filled today, 11jun2025: ARAY, CETX, HUSA, OPI, PLX

Today’s bids sold by 12jun2025: HUSA {ssd}

Bids that filled today, 10jun2025: DGLY, NEOG, POWW, SID, TRIB

Today’s bids sold by 11jun2025: DGLY {ssd}, NEOG {ssd}, POWW {ssd}

Bids that filled today, 09jun2025: ARAY, BCDA, CETX, HAIN, MDXG, STGW, TRIB, UGP

Today’s bids sold by 10jun2025: nil

Bids that filled Friday, 06jun2025: AXL, MERC

Today’s bids sold by 09jun2025: nil

Bids that filled today, 05jun2025: nil

Today’s bids sold by 06jun2025: nil

Bids that filled today, 04jun2025: IOVA, OPI, PLX, STGW, WOLF

Today’s bids sold by 05jun2025: WOLF {ssd}

Bids that filled today, 03jun2025: ABR, BGS, BTAI, DDD, IOVA, LAR, MERC, PLX, POAI, RWT, WOLF

Today’s bids sold by 04jun2025: DDD {ssd}, LAR {ssd}, POAI {ssd}, WOLF {ssd},

Bids that filled today, 02jun2025: AMRX, BCDA, CETX, DVAX, MNKD, MYGN, RMTI, SVRA, VIAV, XRX

Today’s bids sold by 03jun2025: MYGN {ssd}

Bids that filled Friday, 30may2025: DVAX, LBTYA, MERC, SVRA

Today’s bids sold by 02jun2025: SVRA {ssd}

Bids that filled today, 29may2025: BCDA, FLWS, LAR, OPK, SVRA

Today’s bids sold by 30may2025: nil

Bids that filled today, 28may2025: MNKD, MYGN

Today’s bids sold by 29may2025: nil

Bids that filled today, 27may2025: GOGL, IOVA, MPW, MYGN, POWW

Today’s bids sold by 28may2025: nil

Bids that filled Friday, 23may2025: BCDA, EKSO, WOLF

Today’s bids sold by 24may2025: nil

Bids that filled today, 22may2025: LXRX, XTIA

Today’s bids sold by 23may2025: XTIA {ssd}

Bids that filled today, 21may2025: ABUS, LXRX, VIAV

Today’s bids sold by 22may2025: nil

Bids that filled today, 20may2025: IRWD, MNKD, MYGN

Today’s bids sold by 21may2025: nil

Bids that filled today, 19may2025: BTG, DVAX, HAIN, HL, LXRX, MUX, MYGN, NEO, TAK

Today’s bids sold by 20may2025: MYGN {ssd}

Bids that filled today, 16may2025: DVAX, HRTX, MYGN, TAK, VNDA

Today’s bids sold by 19may2025: VNDA {ssd}

Bids that filled today, 15may2025: BGS, BTG, CIG, NG, SVRA

Today’s bids sold by 16may2025: nil

Bids that filled today, 14may2025: UAVS

Today’s bids sold by 15may2025: nil

Bids that filled today, 13may2025: CAPR, HAIN, MERC, MYGN

Today’s bids sold by 14may2025: CAPR {ssd}

Bids that filled today, 12may2025: HL, IRWD, MPW, OPI

Today’s bids sold by 13may2025: nil

Bids that filled today, 09may2025: BTAI, CRDF, GGB, GOVX, HAIN, MERC, PTEN, RILY, TGB, TWI, VRN, VVR, WNC, XTIA

Today’s bids sold by 12may2025: MERC {ssd}, RILY {ssd}

Bids that filled today, 08may2025: AMTX, UAVS

Today’s bids sold by 09may2025: nil

Bids that filled today, 07may2025: HL, RCAT, TGB, TV, WNC

Today’s bids sold by 08may2025: nil

Bids that filled today, 06may2025: HL, SOBR

Today’s bids sold by 07may2025: nil

Bids that filled today, 05may2025: PLCE, WNC

Today’s bids sold by 06may2025: nil

Bids that filled today, 02may2025: AMTX, MRIN, NEO, NEOG

Today’s bids sold by 05may2025: NEO {ssd}, NEOG {ssd}

Bids that filled today, 01may2025: HLX, PLCE, PSEC

Today’s bids sold by 02may2025: nil

Bids that filled today, 30apr2025: HAIN, HLX, MRIN, PTEN

Today’s bids sold by 01may2025: nil

Bids that filled today, 29apr2025: JBLU, MERC, NUS, SSP, WTI

Today’s bids sold by 30apr2025: nil

Bids that filled today, 28apr2025: AIV, GPRE, GTN, NUS, SSP, SVC

Today’s bids sold by 29apr2025: GPRE {ssd}

Bids that filled today, 25apr2025: ALTO, NUS, WTI

Today’s bids sold by 28apr2025: nil

Bids that filled today, 23apr2025: ALTO, GPRE, HUSA, OIS

Today’s bids sold by 24apr2025: nil

Bids that filled today, 22apr2025: ARAY, DBI, EGHT, HAIN, HBI, MRIN, NUS, SVC, WOLF

Today’s bids sold by 23apr2025: MRIN {ssd}

Bids that filled today, 21apr2025: DENN, GERN, HUSA, OPI, SBFM, XRX

Today’s bids sold by 22apr2025: GERN {ssd}

Bids that filled today, 17apr2025: GOVX, HUSA, REI, RILY

Today’s bids sold by 21apr2025: nil

Bids that filled today, 16apr2025: AXL, BHC, OPI, PTEN

Today’s bids sold by 17apr2025: nil

Bids that filled today, 15apr2025: ARAY, BDN, CX, IVR, NYMT, RWT

Today’s bids sold by 16apr2025: nil

Bids that filled today, 14apr2025: AAIV, ALTO, CRDF, FCEL, GREE, GTN, HLX, HUSA, JBLU, LXP, PSEC, RILY, SAVA, SVC, WB, WTI, XRX

Today’s bids sold by 15apr2025: CRDF {ssd}

Bids that filled today, 11apr2025: CIG, EYPT, NG, VNDA

Today’s bids sold by 14apr2025: EYPT {ssd}, NG {ssd}

Bids that filled today, 10apr2025: AXL, CATX, CIK, DSX, JQC, LGF.A, NUS, VVR, XRX

Today’s bids sold by 11apr2025: nil

Bids that filled today, 09apr2025: BCDA, RMTI (CIK didn’t fill for me. Grrrr!)

Today’s bids sold by 10apr2025: nil

Bids that filled today, 08apr2025: BHC, DDD, EYPT, GOVX, INO, LWLG, XRX, XTIA

Today’s bids sold by 09apr2025: nil

Bids that filled today, 07apr2025: AGEN, AMTX, AXL, BLDP, BYON, CLNE, DDD, JBLU, KOSS, KSS, NVAX, PBI, RMTI, SAVA, UIS, WOLF, WULF

Today’s bids sold by 08apr2025: AGEN {ssd}, AMTX {ssd}, DDD {ssd}, SAVA {ssd}, WOLF {ssd}

Bids that filled today, 04apr2025: NVAX

Today’s bids sold by 05apr2025: NVAX {ssd}

Bids that filled today, 03apr2025: nil

Today’s bids sold by 04apr2025: nil

Bids that filled today, 02apr2025: AGEN, BTCS, DENN, DSX, JBLU, KSS, LUMN, XRX

Today’s bids sold by 03apr2025: nil

Bids that filled today, 01apr2025: CRF, CRNT, EGHT, FCEL, IVR

Today’s bids sold by 02apr2025: nil

Bids that filled today, 31mar2025: DDD, VVR

Today’s bids sold by 01apr2025: nil

Bids that filled today, 28mar2025: ALTO, CLNE, DENN, FCEL, INO, IOVA, IVR, LUMN, MRIN, NUS, OPI, WULF

Today’s bids sold by 31mar2025: nil

Bids that filled today, 27mar2025: BYON, XRX

Today’s bids sold by 28mar2025: BYON {ssd}

Bids that filled today, 26mar2025: AGEN, CCO, CRF, CYH, IRWD, JQC, LWLG, MERC, VVR

Today’s bids sold by 27mar2025: nil

Bids that filled today, 25mar2025: CETX, CRNT, DDD, IOVA, KSS, OPI, POWW, TBLA, WULF

Today’s bids sold by 26mar2025: nil

Bids that filled today, 24mar2025: ALTO, DDD, LXRX

Today’s bids sold by 25mar2025: DDD {ssd}

Bids that filled today, 21mar2025: CATX, CERS, CLM, CRF, DENN, IOVA, IRWD, MRIN, NXE, TBLA, TK, XTIA

Today’s bids sold by 24mar2025: nil

Bids that filled today, 20mar2025: AXL, BAK, BTCS, GPRE, IMMR, IRWD, KOSS, NXE, OSUR, PLCE, SB, TTI, UAVS, UIS, WT, WULF, XRX, XTIA

Today’s bids sold by 21mar2025: XTIA {ssd}

Bids that filled today, 19mar2025: CCO, CLM, CRNT, DDD, DENN, JBLU, KSS

Today’s bids sold by 20mar2025: nil

Bids that filled today, 18mar2025: CERS, GERN, LWLG, UAVS, XRX

Today’s bids sold by 19mar2025: nil

Bids that filled today, 17mar2025: AGEN, ARAY, CYH, EGHT, IOVA, KOSS, LXRX, MERC, TTI, UAVS, UIS

Today’s bids sold by 18mar2025: UAVS {ssd}

Bids that filled today, 14mar2025: CATX, DBI, MRIN, TK

Today’s bids sold by 17mar2025: nil

Bids that filled today, 13mar2025: CETX, GERN, IRWD, TTI

Today’s bids sold by 14mar2025: nil

Bids that filled today, 12mar2025: EKSO, GERN, GNW, GREE, IMMR, IOVA, LXRX, NXE, POAI, POWW, WULF

Today’s bids sold by 13mar2025: GERN {ssd}

Bids that filled today, 11mar2025: CLNE, DGLY. IOVA, NPKI, TBLA

Today’s bids sold by 12mar2025: nil

Bids that filled today, 10mar2025: CATX, FCEL, HBI, LWLG, RIG, XRX

Today’s bids sold by 11mar2025: nil

Bids that filled today, 07mar2025: CYRX, DENN, GOVX, GREE, IPA, MUX, SURG, XRX, XTIA

Today’s bids sold by 10mar2025: XRX {ssd}, XTIA {ssd}

Bids that filled today, 06mar2025: AMTX, AXL, BAK, BRFS, CATX, DBI, GERN, GPRE, IRWD, LXRX, MRIN, NPKI, PLCE, POWW, RES, SIGA, TBLA, UAVS

Today’s bids sold by 07mar2025: nil

Bids that filled today, 05mar2025: EKSO, GREE, HBI, IPA, KOSS, LAB, LWLG, NXE, RMTI, WULF

Today’s bids sold by 06mar2025: LAB {ssd}

Bids that filled today, 04mar2025: DBI, FCEL, TBLA

Today’s bids sold by 05mar2025: nil

Bids that filled today, 27feb2025: CATX, CLNE, DHC, GALT, GPRE, NXE, UIS, WULF

Today’s bids sold by 28feb2025: nil

Bids that filled today, 26feb2025: CDE, CYRX, GNW, KOSS, MUX, NG

Today’s bids sold by 27feb2025: nil

Bids that filled today, 25feb2025: DENN, HBI, LAB, MDXG. RIG, TK

Today’s bids sold by 26feb2025: nil

Bids that filled today, 24feb2025: AMTX, AXL, GPRE

Today’s bids sold by 25feb2025: nil

Bids that filled today, 21feb2025: AMTX, CETX, GERN, GREE, LAR, SOBR, SSP, WT

Today’s bids sold by 24feb2025: SOBR {ssd}

Bids that filled today, 20feb2025: AG, BTAI, CETX, COTY, GREE, HBI, SBFM

Today’s bids sold by 21feb2025: nil

Bids that filled today, 19feb2025: BHC, BTAI, HBI, LUMN, OTRK

Today’s bids sold by 20feb2025: nil

Bids that filled today, 18feb2025: CYRX, EYPT, GOVX, HLX, INO, LAR, LXRX, RWT, SSP, SVRA

Today’s bids sold by 19feb2025: nil

Bids that filled today, 14feb2025: BRFS, COTY, FCEL, GREE

Today’s bids sold by 18febjan2025: nil

Bids that filled today, 13feb2025: AMTX, GT, IRWD, OTRK, RMTI, SAVA

Today’s bids sold by 14feb2025: nil

Bids that filled today, 12feb2025: BGS, BHC, BKD, GOVX, JQC, NMHI, OPI, TBLA, WT

Today’s bids sold by 13feb2025: GOVX {ssd}

Bids that filled today, 11feb2025: BDN, CETX, MUX, NPKI, WOLF

Today’s bids sold by 12feb2025: nil

Bids that filled today, 10feb2025: ABUS, ARI, BHC, HLX, LGHL, OPI, SB, SIGA, UAVS, WT, WTI

Today’s bids sold by 11feb2025: nil

Bids that filled today, 07feb2025: GREE, OPI, PLCE, SB, UGP, UMC

Today’s bids sold by 10febjan2025: nil

Bids that filled today, 06feb2025: AG, AQN, BRFS, CDXC, DENN, EKSO, EYPT, FCEL, PSEC, UAVS, VRN, WOLF

Today’s bids sold by 07feb2025: nil

Bids that filled today, 05feb2025: AMTX, BLDP, DGLY, GERN, NXE, SIGA, SURG, WTI

Today’s bids sold by 06feb2025: nil

Bids that filled today, 04feb2025: AXL, BHC, CETX, DBI, EGY, FCEL, GT, HLX, KOSS, LAR, NPKI, SAVA, SSP, VRN

Today’s bids sold by 05feb2025: FCEL {ssd}

Bids that filled today, 03feb2025: AG, AQN, GTN, MUX, NG, TEF, XTIA

Today’s bids sold by 04feb2025: nil

Bids that filled today, 31jan2025: ABEV, BGC, DBI, DGLY, EYPT, GERN, IGR, MPW, NYMT, OSUR, POWW, SVRA

Today’s bids sold by 03febjan2025: nil

Bids that filled today, 30jan2025: BRFS, BTG, EGY, FCEL, GREE, HLX, KOSS, NPKI, SSP, UMC

Today’s bids sold by 31febjan2025: nil

Bids that filled today, 29jan2025: ACET, AGEN, AMTX, CHGG, FLG, GT, LGHL, NXE, NYMT, UAVS, WOLF, WT, WULF

Today’s bids sold by 30febjan2025: CHGG {ssd}, NXE {ssd}

Bids that filled today, 28jan2025: BBD, BCDA, BLDP, CDXC, CIG, CX, IGR, NG, SAND, SB, SURG, XTIA

Today’s bids sold by 29febjan2025: nil

Bids that filled today, 27jan2025: BKD, CATX, CCO, CHGG, DHC, GTN, HRTX, IPA, LXRX, MPW, MRIN, OSUR, OTRK, PSEC, SURG, SVC, VNDA, WOLF, WTI

Today’s bids sold by 28febjan2025: DHC {ssd}

Bids that filled today, 24jan2025: ACET, AGEN, BCRX, BDN, BHC, CATX, DENN, EBR, GALT, GNW, HBI, HL, NPKI, NVRI, OIS, SVC

Today’s bids sold by 27jan2025: CATX (ssd)

Bids that filled today, 23jan2025: BRFS, BTAI, CETX, EGHT, EYPT, GERN, GTN, JQC, LTBR, LUMN, LXRX, OPI, OTRK, PBI, PLG, SIGA, TV, UGP, WULF

Today’s bids sold by 24jan2025: PBI {ssd}, LTBR {ssd}, WULF {ssd}, LXRX {ssd}

Bids that filled today, 22jan2025: ABEV, BGS, BTG, DHC, FLG, IEP, INO, IOVA, KOSS, LGF-A, LTBR, RMTI, SIGA, VNDA

Today’s bids sold by 23jan2025: nil

Bids that filled today, 21jan2025: LPTV, WB, SSYS

Today’s bids sold by 22jan2025: nil

Bids that filled today, 17jan2025: LTBR, LAAC, IVR, RWT, INO, GREE, XTIA

Today’s bids sold by 21jan2025: GREE (ssd), XTIA (ssd), INO (ssd)

Bids that filled today, 16jan2025: DGLY, DHC, GERN, SID, SNGX

Today’s bids sold by 17jan2025: nil

Bids that filled today, 15jan2025: ABEV, AG, BGS, BTG, CDE, GOGL, HL, MUX, NG, NUS, NXE, OPI, SAVA, TBLA

Today’s bids sold by 16jan2025: nil

Bids that filled today, 14jan2025: AGNC, AQN, ARAY, BBD, BYON, IVR, LAAC, LYG, OSUR, PLCE, RWT, SB, SVRA

Today’s bids sold by 15jan2025: nil

Bids that filled today, 13jan2025: AMTX, CATX, CCO, CERS, ITUB, LTBR, MPW, POAI, SVC

Today’s bids sold by 14jan2025: CERS {ssd}

Bids that filled today, 10jan2025: AG, BB, CGAU, HL

Today’s bids sold by 13jan2025: nil

Bids that filled today, 08jan2025: ABEV, BHC, CDE, DBI, MPW, OSUR, PERI, PW, SPXS, SVC, VVR

Today’s bids sold by 10jan2025: nil

Bids that filled today, 07jan2025: ATEC, AXL, COTY, LXP, OPI, SSYS, LPTV

Today’s bids sold by 08jan2025: nil

Bids that filled today, 06jan2025: IGR, NAT, NMR, PLCE, RMTI

Today’s bids sold by 07jan2025: nil

Bids that filled today, 03jan2025: AGNC, CATX, IOVA, PLUG, RWT, SURG, TGB

Today’s bids sold by 06jan2025: CATX {ssd}, PLUG {ssd}

Bids that filled today, 02jan2025: AXL, CATX, CERS, COTY, DBI, DGLY, DHC, GT, NUS, OPI, OSUR, RIOT, SSYS, UGP

Today’s bids sold by 03jan2025: CATX {ssd}

See previous weekend issues for pre-2025 bid lists.

Disclaimer

The contents of this newsletter are believed to be reliable, but the accuracy or completeness of any information contained herein is not guaranteed and members of Baker’s Stock Trading Aids shall not in any way be liable for any delay in keeping such information current. Members of Baker’s Stock Trading Aids specifically disclaim all warranties, express or implied.

Although Baker’s Stock Trading Aids believes that the information provided on these pages is accurate, it provides no warranty with respect thereto. The information may not be suitable for all persons; it should not be relied upon in connection with a particular investor's trading; and, is not intended to be, nor should be construed as, an offer, recommendation or solicitation. Baker’s Stock Trading Aids does not provide investment advice, but a record of potential and actual trades by the author. The information in this newsletter is not intended for persons who reside in jurisdictions where providing such information would violate the laws or regulations of such jurisdiction.

Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Baker’s Stock Trading Aids does not provide investment advice or recommendations regarding the purchase or sale of any securities or derivatives.